Weekly update - What we are made of

*Please note that Global Solutions is an offshore fund only available in the Channel Islands and Isle of Man. It is not available to UK investors.

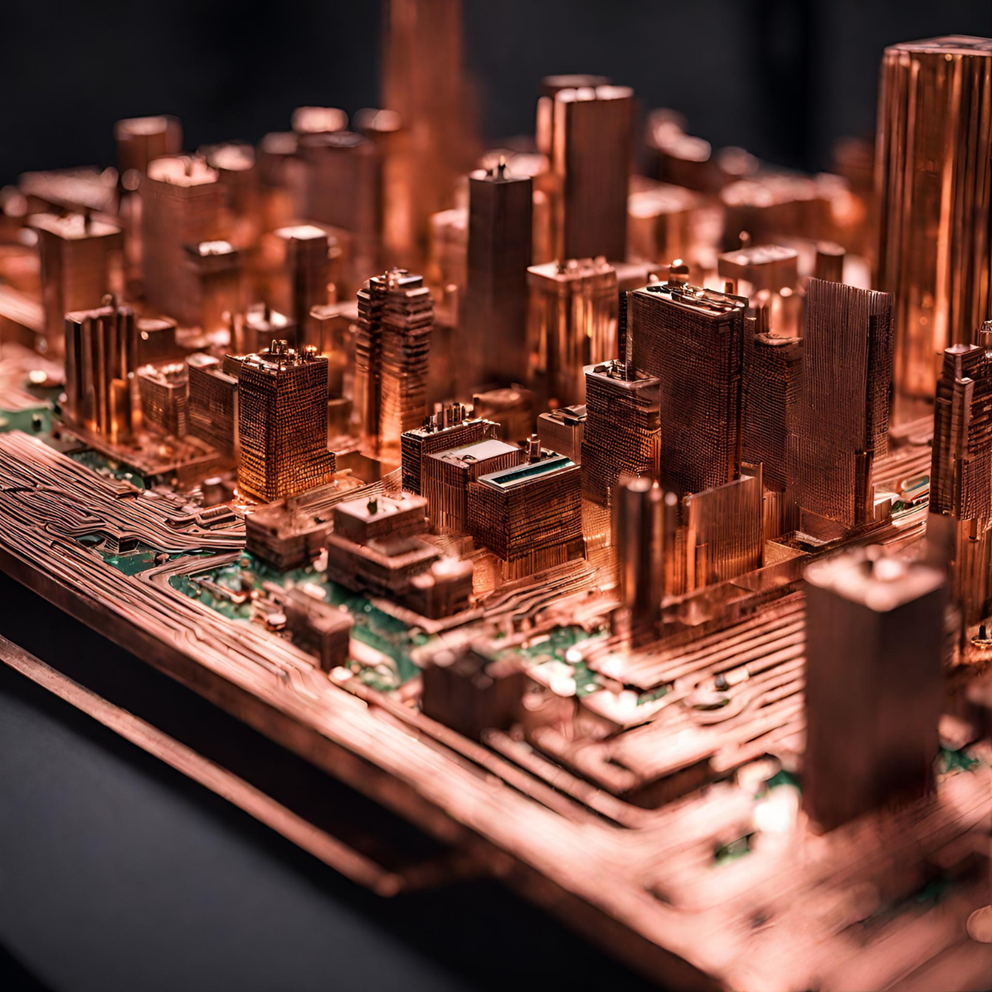

It might be hard to imagine, but the screen you are reading this on likely started life as rocks underground. Sands refined in a lengthy process are turned into semiconductors and our glass screens. The wiring in our phones begins life as copper; the phone case is often made from stainless steel from iron ore. Salt, an easily overlooked seasoning or pre-tequila necessity, is required to help create the chemicals we need in many processes. Batteries from lithium and graphite from crude oil are also used.

Zooming out from our devices, the most fundamental parts of our daily lives derive from six substances: sand, iron, salt, copper, oil and lithium. As the population grows globally, the demand for these materials increases, which is highlighted in Ed Conway’s book, Material World. This book takes readers around the world to learn more about the substances and the little-known companies that are required in their processing. It is a book filled with shocking quotes and statistics, including the fact that we dug more stuff out of the earth in 2017 alone than in all of human history before 1950. There is a material world people don’t think about all that often. It’s the one that provides the raw metals and chemicals that keep economies and societies moving.

As I was reading the book, I recognised many of the relatively unheard-of businesses Conway discussed. Many of these are held in the Ravenscroft Global Solutions fund, which includes resource scarcity as one of the five themes the portfolio is constructed around. The fund, which celebrates its second anniversary at the end of March, has existed during a period of heightened market volatility and geopolitical uncertainty. As we wrestle with a changing climate, energy crises and new global conflicts, where we get, how we process and who controls sand, salt, oil, iron, copper and lithium matters more than ever before. The increased recognition of this fact and the ever-growing use of these materials has been reflected in positive fund-level returns for some of our underlying holdings.

Some of our best-performing funds have been those that are invested along the supply chain and that blend themes together. This approach means they can ensure portfolios are diversified enough to withstand market turmoil. For example, when we talk about environmental solutions many people automatically think of renewable energy, which plays a crucial part, but it is just one of many solutions. Environmental solutions are broad and diverse. They range from energy efficiency technologies, water technologies and waste management to software companies that are enabling the digitalisation of manufacturing. Energy transition has been a challenging area to be invested in so a more diversified approach has benefited a number of our funds. Fund managers who have blended waste or food with water, for example, have outperformed their peers. Some fund managers have a low purity threshold for stock inclusions in their portfolio so they can expand their investible universe. We prefer to find managers with high purity and if they do not feel the universe is big enough to warrant a standalone fund, they blend their exposures with other themes.

Our fund managers are always revisiting their universes, portfolios and processes to make sure they are capturing the most appropriate companies. They often look nothing like the index which has been benefiting from concentrated market leadership. They are looking for the unsung heroes and underappreciated companies that don’t make headlines. Material World is a celebration of human innovation, the miraculous processes and the little-known companies that come together to turn raw materials into things of wonder. As we look along the supply chain of these key materials, there are many exciting investment opportunities that harness human innovation and our ability to adapt as a society. This presents investment opportunities and forms the basis of Global Solutions, which invests in businesses aiming to help solve some of the world’s greatest challenges in areas such as environmental solutions, emerging equality, basic needs, energy transition and resource scarcity.

After a difficult period of performance, we are seeing some positive momentum in our underlying Global Solutions funds, which has been pleasing. The themes underpinning the portfolio are still very much at play and unfolding around us. We still expect a huge increase in global populations and we know that three billion more middle-class consumers by 2030 will put incredible pressure on the world’s finite natural resources. As recognition of this grows, the companies we have exposure to should benefit, powered by these long-term, irrefutable trends driving change. We are invested in the companies that are instrumental in creating our devices and the world around us, as well as in the businesses that will innovate and help us continue to use these incredible materials.